Convergence Commentary - May 2025

Quick Hits

Stocks rebound sharply from April lows

Trade announcements continue to drive market action

Moody’s downgrades US debt

Market-Moving Highlights

May was a month filled with competing headlines in a fast-moving market.

First up was a Federal Reserve decision to keep interest rates unchanged at their regularly scheduled FOMC meeting. That was the third such decision this year, following a full percentage point of cuts over the final 6 months of 2024. In Fed Chair Powell’s view, current economic data doesn’t warrant a cut. While ‘soft’ data (consumer and business surveys) have deteriorated significantly, ‘hard’ data (consumer spending and jobs numbers) haven’t shown the same level of weakness. That doesn’t mean Fed officials are ignoring the risks to their outlook. But in their view, the risks to achieving both components of their dual mandate – price stability and full employment - have increased. And that makes the path of policy uncertain.

Focus quickly shifted from the Fed to trade negotiations, as the Trump administration announced preliminary deals with both the United Kingdom and China in the early part of the month. Stocks rallied on the news, though both ‘agreements’ lacked meaningful details, and talks with both parties will continue throughout the summer. As if that weren’t enough to think about, President Trump threatened to raise tariffs on the EU by 50% on June 1st after what he called a lack of progress in discussions. A phone call with European Commission President Ursula von der Leyen shortly after those comments prompted a quick reversal and a July 9th deal deadline instead.

The biggest news of the month, however, may have been Moody’s decision on May 16th to downgrade US debt, which effectively stripped the United States of its only remaining ‘perfect’ credit rating.

Index Performance

The S&P 500 turned in its best performance in 18 months, recording a 6.3% gain to end May in positive territory for the year. The growth-oriented NASDAQ Composite rose even more, up nearly 10% for the month. Despite that, both the NASDAQ and the Russell 2000 index of small cap stocks remain in negative territory for 2025. Over longer timeframes, however, the recent bout of volatility is hard to see. The S&P 500 has risen 13.5% over the last 12-months and has annualized at more than 15% from this time in (a COVID-impacted) 2020.

International stocks lagged their US counterparts in May but still managed to rise a respectable 4.6%. That’s especially impressive because, unlike stocks here at home, foreign equities weren’t rebounding from a major low. To the contrary, the MSCI ACWI Ex-US Index is now up 14% for the year. What’s more, last month’s closing price was the highest on record.

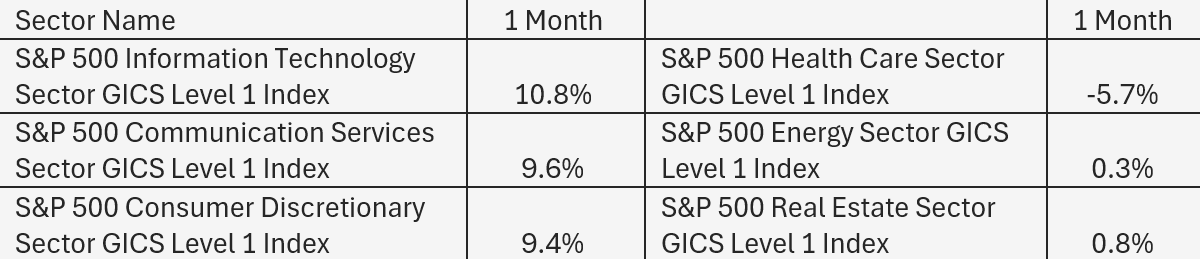

S&P 500 Sector Highlights

Growth stocks continued to lead the rebound in May after a strong finish to April. The three growth-oriented sectors – Information Technology, Communication Services, and Consumer Discretionary – each rose more than 9% for the month as trade tensions eased and risk appetite returned to the market. All but one of the 11 S&P 500 sectors were positive for in May.

The outlier was Health Care, which dropped a staggering 5.7%, thanks in large part to a CEO-shuffle, suspended guidance, and a criminal investigation for Medicare fraud at the nation’s largest health insurer. By comparison, the equally weighted Health Care sector (rather than the market cap weighted group, which places increased importance on the largest companies) was off just 0.3% for the month.

What to Watch in June

6/6 – BLS Jobs Report

The Federal Reserve began cutting interest rates last fall largely on concerns that the labor market was showing undue signs of weakness. That weakness wasn’t sustained. At 4.2%, the unemployment rate today is the same as it was last July, and far below the non-recession average of 5.6% of the last 70 years. In May, economists expect that the US economy added another 177,000 to non-farm payrolls.

6/11 – Consumer Price Index - May

Progress on price inflation stalled in the back half of 2024, and that’s a big reason the Fed was forced to adjust their policy outlook for 2025. Price data sent some concerning signals in January but reports over the past few months should give consumers and policy officials alike some confidence about the trend of price pressures. In April, CPI fell to its lowest level in 4 years.

6/17 – Retail Sales – May

Judging by most consumer surveys, economic conditions are bad and getting worse. Given the din of tariff announcements, ongoing price pressures, and relatively high interest rates, it’s not hard to see why. Despite all that, there’s a big difference between what consumers are saying and what they’re doing. On a year-over-year basis - and after adjusting for inflation - retail sales in March and April grew faster than at any point in the prior 3 years.

6/18 – FOMC Rate Decision

The Federal Reserve began cutting interest rates last year, but a resilient labor market and stubbornly high inflation forced them to place a hold on looser monetary policy. Now, they’re weighing the competing impacts of tariff policy on their dual mandate – that of potentially higher inflation vs. potentially slower growth. Unless something drastic happens over the next few weeks, don’t expect a policy change this month. Instead, watch for details in the Summary of Economic Projections on how Fed officials’ own expectations have changed since March. That may give clues about policy decisions later this year.

6/26 – GDP – Q1, Final estimate

The second estimate of Q1 GDP showed that the US economy contracted in the first three months of the year. The decline was almost entirely due to a surge in imports, likely as businesses stockpiled goods in an effort to front run expected tariff announcements. Beneath the surface, the focus in the final GDP release will be on the strength of consumer spending and trends in business investment.

Market Wrap

In mid-May, Moody’s Ratings downgraded the US to Aa1 from Aaa on growing concerns about the level and trend of federal debt. Moody’s decision follows similar decisions by S&P (2011) and Fitch (2023) and effectively strips the US of its final top-tier rating.

The downgrade tells us something we all already knew: the trajectory of US fiscal policy is unsustainable. While arguments can be made that the level of debt is manageable, neither political party has shown an appetite for reducing fiscal deficits. And it seems that isn’t going to change any time soon. In May, the House of Representatives advanced a tax and spending package that - at least in its current form – is expected to lead to even wider deficits in the coming years.

For now, there’s plenty of global appetite for US credit instruments and the Treasury has no immediate concerns about its ability to continue financing government operations. That’s good news for all of us. Still, the latest downgrade will add to growing concerns about the end of US reserve currency status and a changing world order.

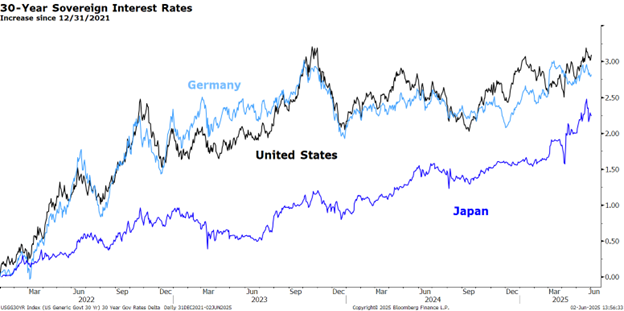

Though 30-year Treasury yields surpassed 5% and briefly matched 15-year highs in the days following the downgrade, higher interest rates are not exclusive to US markets. We’re seeing the same trends in other developed markets. In Japan, the 30-year government borrowing rate just hit its highest level on record.

Bureau of Economic Analysis: https://www.bea.gov/data/gdp/gross-domestic-product

Bureau of Labor Statistics: https://www.bls.gov/

US Census Bureau: https://www.census.gov/retail/sales.html

Market performance data sourced from Bloomberg Finance L.P. and Optuma