Convergence Commentary - June 2025

Quick Hits

Market-Moving Highlights

We’re mid-way through 2025, and on the surface, the world doesn’t look so different than it did 6 months ago: US stocks are at record highs, valuations are elevated, inflation is above the Federal Reserve’s 2% target, and interest rates are stubbornly elevated. Through that lens, an outsider may get the impression that the first half of the year was uneventful. It was anything but. Instead, the first half included a sharp, tari-induced stock market selloff and ended with a breathtaking – if uneven – rally back to the former highs. We endured volatility from announcements around new AI technologies, trade agreements, reflation fears, federal debt levels, geopolitics, and just about everything in between.

June may have been the most ‘boring’ month of the year. It lacked major headlines on either trade, Federal Reserve policy, inflation trends, or fiscal policy. The biggest news came out of the Middle East, with Israel launching a preemptive strike on Iranian nuclear facilities, Iran launching hundreds of ballistic missiles in retaliation, and the United States launching its own strikes on June 22. The 12-day conflict, which ended with a US-brokered ceasefire agreement on the 24th, had significant geopolitical implications. But according to Mr. Market? It was much ado about nothing. Equities marched steadily higher throughout the period, and though oil prices initially surged on the news, crude ended the month at the same level it was before the fighting began.

Perhaps the market is saving all its energy for July. There’s plenty to watch for in the weeks ahead. In Washington, Congress is working frantically to get the ‘Big, Beautiful Bill’ on President Trump’s desk. If they’re successful - and even if they’re not - the final details could have major bond market implications. Next on the agenda is trade, with the Trump Administration’s 90-day pause on reciprocal taris set to expire on July 9th and few new trade agreements in place. Then attention will turn to Jerome Powell and the Fed, where they’ll have the opportunity to adjust interest rate policy. Powell has vowed to remain patient and data dependent, but a few of his peers have publicly mused about the benefits of cutting in July.

Stay tuned.

Index Performance

The S&P 500 rose another 5% in June to close at a new all-time high. The NASDAQ Composite rose even more, adding 6.6% and reaching a new high of its own. Both the S&P 500 and the NASDAQ are up more than 15% over the last 12-months. Value-oriented indices aren’t quite as strong. Both the Dow Jones Industrial Average and the Russell 2000 small cap index are still stuck below their Q4 2024 highs.

International stocks lagged their US counterparts again in June but still managed to add to their banner year, rising another 3.4%. That puts the MSCI ACWI Ex-US Index up almost 18% for the year. Bond prices also rose, with the US Aggregate bond index on pace for its best year since 2020.

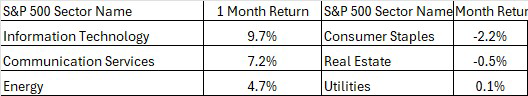

S&P 500 Sector Highlights

Growth stocks continued to lead the rebound in June, with the Information Technology sector dragging the overall index higher with a 9.7% gain. Tech is one of four sectors to have reached a new all-time high in June, along with Communication Services, Industrials, and Financials. The Industrials haven’t topped the leaderboard in any month this year – or even appeared in the top 3 – yet they’ve been the best sector so far in 2025, up nearly 12%.

Defensive sectors lagged in June, as investors eschewed safety in favor of risky assets. Consumer Staples was the biggest loser for the month but is still higher by 5% on the year. The Utilities sector managed to close in the green despite being buffeted by headlines out of Washington that the Big Beautiful Bill could disrupt investments in the renewable energy space.

What to Watch in July

7/3 – BLS Jobs Report

The Federal Reserve began cutting interest rates last fall largely on concerns that the labor market was showing undue signs of weakness. That weakness wasn’t sustained. At 4.2%, the unemployment rate today is the same as it was last July, and far below the nonrecession average of 5.6% of the last 70 years. In June, though, economists expect to see some softening, with unemployment rising to 4.3%.

7/9 – Country-level reciprocal tariffs are set to expire. Potential outcomes range from new trade deal announcements, to extensions, to one of the largest tax increases in decades.

7/15 – Consumer Price Index - June

Progress on price inflation stalled in the back half of 2024, and that’s a big reason the Fed was forced to adjust their policy outlook for 2025. In May, CPI failed to make much progress, and economists expect tariffs to spur prices higher again in June. Core CPI is expected to rise to 3.0% from 2.8%.

7/17 – Retail Sales – June

Retail sales dropped sharply in May, falling 0.9% from April’s elevated level. Compared to this time last year, however, spending still looks relatively healthy. Most consumer surveys imply that economic conditions are bad and getting worse. Despite all that, so far there’s been a big difference between what consumers are saying and what they’re doing. We’ll see whether the May slowdown continued in June.

7/30 – FOMC Rate Decision

The Federal Reserve began cutting interest rates last year, but a resilient labor market and trade policy that’s set to keep inflation running hotter for longer has forced them to keep policy on hold. The latest Summary of Economic Projections showed that most Fed participants still see 2 more cuts in 2025. But the timing of those cuts is uncertain.

7/30 – GDP – Q2, First estimate

The final estimate of Q1 GDP showed that the US economy contracted in the first three months of the year. The decline was almost entirely due to a surge in imports, likely as businesses stockpiled goods in an eort to front run expected tariff announcements. The effects of trade are expected to reverse in Q2, which should mean a rebound in this measure of economic growth. The Atlanta Fed’s GDPNow real GDP estimate for Q2 stands at 2.5%, including a 3.5% contribution from net exports.

Market Wrap

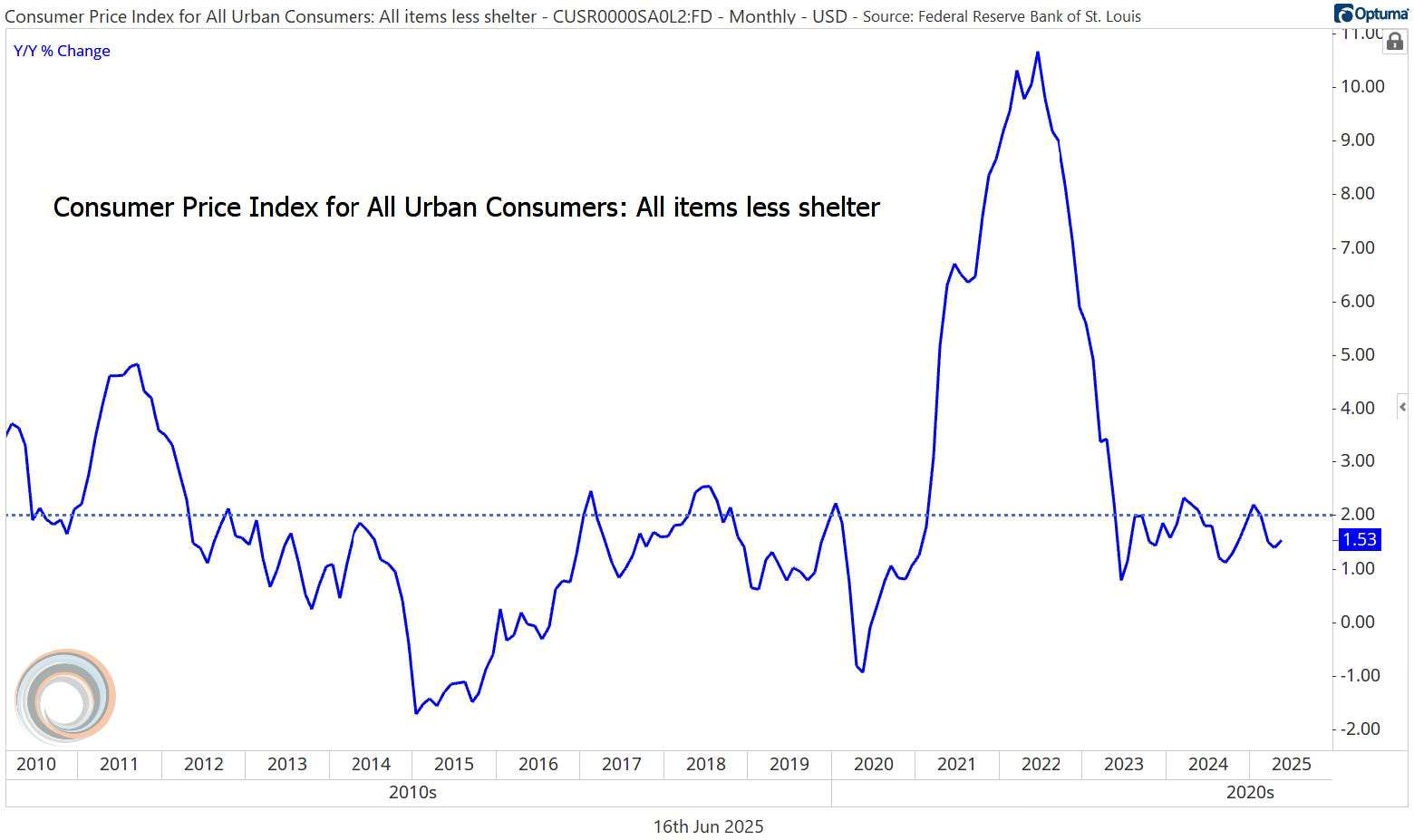

Last month’s CPI report pointed toward further progress on prices, with core inflation holding steady at 2.8%. That was below consensus expectations of modest increase to 2.9%. True, inflation at 2.8% is still well above the Fed’s official target of 2.0%, and more progress is required before Jerome Powell and his colleagues can declare victory. But underlying trends are encouraging, to say the least.

Shelter comprises more than one-third of the headline CPI number and nearly half of the core. In May, shelter inflation dropped to the lowest level since 2021. And if the current trend continues, it could return to pre-COVID levels by the end of the summer.

That’s good news for the Fed, because housing costs have been the thorn in their side for years. Meanwhile, inflation excluding shelter has been at target since mid-2023.

Bureau of Economic Analysis: https://www.bea.gov/data/gdp/gross-domestic-product

Bureau of Labor Statistics: https://www.bls.gov/

US Census Bureau: https://www.census.gov/retail/sales.html

Market performance data sourced from Bloomberg Finance L.P. and Optuma