Convergence Commentary - August 2025

Quick Hits

Market-Moving Highlights

At the start of August, Adriana Kugler made the somewhat surprising decision to step down from her position as a governor at the Federal Reserve. Kugler was appointed by President Biden in 2022 and was set to serve until next January. No one expected Kugler to be reappointed by President Trump next spring, but her premature departure accelerated the timeline for Trump to install his own pick at the Fed.

The administration settled on Stephen Miran to fill the opening. Miran, a Harvard-trained economist who currently heads the President’s Council of Economic Advisers, will need to earn Senate approval for his appointment and will still face an expiring term in January. If approved, however, he’ll have the chance to shape monetary policy at the Federal Reserve in the coming months.

Further changes for the Fed could be coming soon. President Trump publicly ridiculed and threatened to fire Chair Powell (whose term as Chair ends next year) all summer. Last week, he ramped up the pressure by firing Governor Lisa Cook, another Biden appointee. The President can’t fire Fed governors without ‘cause’, however, so Cook’s true fate rests in the hands of the courts.

Already at the Fed, two camps are vying for control. The hawks, led by Chair Powell, have been cautious about inflation and have argued for keeping interest rates moderately restrictive. The doves, led by Governor Waller, have pointed to growing weakness in the labor market as evidence that looser policy is needed. Miran will undoubtedly align with Waller, and so would a replacement for Cook.

Of course, Fed policy may shift before any new members are appointed.

The market waited with bated breath for Jerome Powell’s speech at last month’s Jackson Hole Economic Symposium, hoping for a sign that rate cuts were coming down the pike. Watchers weren’t left disappointed. The Fed Chairman refrained from offering explicit guidance, but acknowledged that the winds are shifting:

“With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance”

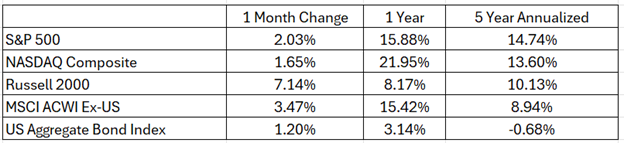

Index Performance

The S&P 500 rose another 2% in August, setting a new all-time monthly closing high. The Russell 2000 Index of small cap stocks was the big winner, though, adding 7.1% and hitting its highest level since last December. The Russell’s outperformance was part of a broader shift that favored value-oriented stocks during the month. Within large caps, the growth-tilted NASDAQ rose just 1.6%, while the Dow Jones Industrial Average jumped 3.2% en route to its first new high of the year.

International stocks – another beneficiary of the shift towards value – rose 3.5%. In 2025, they’re now up more than 20%. Interest rates, meanwhile, fell in August, pushing the US Aggregate Bond Index up 5% for the year.

S&P 500 Sector Highlights

After several months that were completely dominated by large cap Tech, a new group of leaders emerged in August. The Materials sector, highlighted by copper and gold miners, jumped 5.6%. Health Care stocks weren’t far behind, climbing 5.2%. Despite the big month, though, Health Care is the only sector still in negative territory for 2025. On the opposite end of the spectrum, Communication Services is the year-to-date leader, up 17% since December after another 3.6% gain last month.

On the downside, Utilities stocks fell 2%, dragged lower by sharp declines in two of the sector’s largest components – both of which were coming off large gains in July. The Industrials sector also fell in August, though it’s still among the best-performing sectors this year.

What to Watch in September

9/5 – BLS Jobs Report – August

After last month saw the largest non-recessionary revision to a jobs report on record, investors will be watching to see whether the employment slowdown continued in August. Likely more important than the number of payrolls added will be the unemployment rate. That’s one of the key measures Fed Chair Powell said he’s watching to determine whether supply and demand in the labor market are in balance.

9/11 – Consumer Price Index - August

Progress on price inflation stalled in the back half of 2024, and that’s a big reason the Fed was forced to adjust their policy outlook for 2025. Even with the labor market showing cracks, it’s been tough for policymakers to loosen their grip on growth without seeing receding price pressure. Core CPI jumped to 3.1% in July thanks to contributions from airfares, vehicle prices, and medical care services. On the bright side, shelter inflation continued to normalize.

9/16 – Retail Sales – August

Retail sales continued to climb in July, thanks in part to summertime sales by the two largest US retailers. So far, consumers have been able to shake off more than a little uncertainty about the future, including prospects of higher prices from tariffs and a slowing labor market. This month’s release will show whether spenders pulled back at all during the back-to-school shopping season.

9/17 – FOMC Decision

Amid growing political pressure, the Federal Reserve will once again meet to decide whether or not to lower interest rates. Chair Powell opened the door for a potential adjustment during his most recent public event, but he refrained from offering explicit guidance. The decision likely hangs on jobs and inflation data between now and the meeting date.

9/25 – GDP – Q2, final estimate

The second estimate of Q2 GDP showed that the US economy rebounded 3.1%, following a contraction in Q1. Both Q1 and Q2 were skewed by importers working to front-run tariff implementation by stockpiling inventories last winter. Those effects appear to be virtually zero-sum over the first half, however, which means we can get a reasonable read on US growth by averaging the two reports. Doing so implies that GDP continued to grow at a moderate pace, led by a consumer that continues to spend.

Market Wrap

At its core, the level of the stock market can be boiled down to just two components: earnings, and the price multiple investors are willing to pay for those earnings.

Earnings per share (EPS) are reported each quarter by the companies themselves. They tend to rise during economic expansions and contract during recessions, but over the long-term, they’ve grown at a pace of roughly 7% per year. Over the last 5 years, growth has been even stronger - EPS has annualized at more than 10%.

That strong earnings growth has been one of the key drivers of above average stock market returns for the past few years, but it hasn’t been earnings alone. Investors have also been willing to pay higher prices. The forward p/e on the S&P 500 (the multiple placed on expected earnings over the next 12 months) has risen from about 18.5x prior to the pandemic to more than 22x today. The long-term average multiple is closer to 15x. In short, stocks are rather expensive relative to historical norms.

Is that premium price warranted? Perhaps. Faster future growth should be rewarded with higher prices, and the future is certainly filled with opportunity (whether that be from AI-related productivity enhancements, expansionary fiscal policy, or a broad-based reacceleration in global economic growth).

On the other hand, price multiples are really just reflections of investor sentiment, and sentiment can be fickle. Even if earnings do materialize, wavering confidence could cause stocks to fall.

Bureau of Economic Analysis: https://www.bea.gov/data/gdp/gross-domestic-product

Bureau of Labor Statistics: https://www.bls.gov/

US Census Bureau: https://www.census.gov/retail/sales.html

Federal Reserve: https://www.federalreserve.gov/

Market performance data sourced from Bloomberg Finance L.P. and Optuma