Convergence Commentary - October 2025

Quick Hits

Market-Moving Highlights

The Federal Reserve lowered interest rates by another 0.25% last week, the second straight cut after keeping policy steady for the first 9 months of the year. Futures markets had fully priced in the cut ahead of the meeting. The Fed also lived up to consensus expectations when announcing plans to end its balance sheet runoff (a behind-the-scenes process started in 2022 to unwind stimulus provided during the pandemic) by year-end. Not everything went according to ‘plan’, though. Markets had fully priced in one additional 0.25% rate cut this year, at the December FOMC meeting. But speaking at his post-meeting press conference, Fed Chair Jerome Powell put those expectations on ice:

“A further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it.”

There’s been plenty of political pressure to lower rates more quickly. Stephen Miran, the most recent appointee at the Fed and a close ally of President Trump, dissented from Wednesday’s decision in favor of a 0.50% reduction. Miran’s dovish view is far from consensus. Kansas City Federal Reserve President Jeff Schmid also dissented from last week’s decision to cut by a quarter-point, but he did so in a hawkish direction, favoring no cut at all. In Schmid’s view, the risks to inflation are still paramount:

“I do not think a 25-basis point reduction in the policy rate will do much to address stresses in the labor market that more likely than not arise from structural changes in technology and demographics. However, a cut could have longer-lasting effects on inflation if the Fed’s commitment to its 2% inflation objective comes into question.”

As a regional Federal Reserve Bank President, Schmid will rotate to a non-voting position after year-end (while governors like Powell and Miran vote at every meeting). At least one hawk is set to take Schmid’s place, however. Speaking in the days after the meeting, Dallas President Lorie Logan espoused kindred views:

“I did not see a need to cut rates this week. And I’d find it difficult to cut rates again in December unless there is clear evidence that inflation will fall faster than expected or that the labor market will cool more rapidly.”

The final Fed decision of 2026 lies firmly in the hands of upcoming economic data releases – releases that are largely on hiatus thanks to a month-long government shutdown.

Index Performance

Market prices rose to more record highs during the month, adding to another year of above-average gains for equities. The S&P 500 has risen 17.5% this year, even after the sharp spring selloff. Growth stocks are once again leading the charge, with the NASDAQ Composite up nearly 5% in October and up more than 20% for the year. The small caps, meanwhile, continued to lag, rising a more modest 1.8%. International equities also failed to keep pace with US large caps during the month, but they’re still the leader in 2026, up 28%.

Interest rates, fell again last month, pushing the US Aggregate Bond Index up for the third straight month.

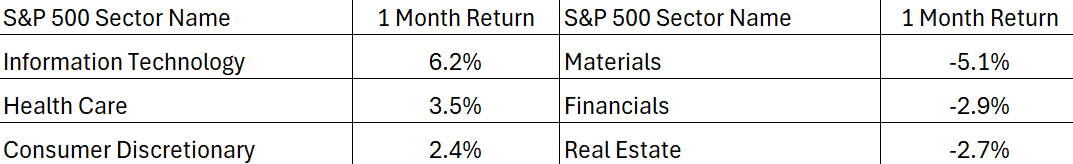

S&P 500 Sector Highlights

Information Technology was the top sector once again in October and returned to the top of the leaderboard on a year-to-date basis as well. Strong earnings reports helped drive the move, as Tech posted 26% earnings growth in Q3. Health Care stocks had one of their best monthly performances of the year, rising 3.5%.

On the downside, Materials stocks dropped 5%, dragged lower by a sharp decline in the sector’s largest component, a global industrial gases and engineering company. The Financials sector also fell, after a handful of unexpected bankruptcies aroused concerns about the health of bank balance sheets.

What to Watch in November

The government shutdown has delayed a growing list of economic data. Below, we highlight the scheduled release date of some key reports.

11/7 – BLS Jobs Report – October

Labor market softening helped the Federal Reserve justify a resumption of interest rate cuts, but the path forward is murky. Going forward, Jerome Powell & Co. will need to decide whether the risks to their employment mandate still outweigh the risks to higher inflation.

11/13 – Consumer Price Index - October

CPI was one of the few reports published in October in spite of the shutdown, as the data was needed for COLA adjustments to Social Security payments. The report was mostly in-line with expectations, but still showed core inflation rising to 3.0%. That’s the highest reading in more than a year.

11/14 – Retail Sales – October

Retail sales surged in August, thanks to a strong back to school shopping season, but we’ve yet to see whether that was a one-time spending spree or evidence that consumers are strengthening. Consumption makes up about two-thirds of the US economy, and those all-important consumers continue to shake off uncertainty about tariff and interest rate policy. This month’s release could contain early glimpses of the holiday.

11/26 – GDP – Q3

Second quarter GDP was revised up to 3.8% from a 3.3% annualized rate. Both Q1 and Q2 were skewed by importers working to front-run tariff implementation by stockpiling inventories last winter. This estimate of Q3 GDP will give a cleaner look at how the US economy is actually performing.

Market Wrap

The word of the month was ‘cockroach’. Speaking after his company reported a $170 million write-off related to the bankruptcy of a subprime auto lender, JPMorgan CEO Jamie Dimon warned about further risks in the banking sector:

“When you see one cockroach, there are probably more”

Just a few days later, unexpected write-offs from Zions Bancorporation and Western Alliance Bancorp - both related to alleged fraud by a distressed mortgage investor - sent the entire regional banking industry into a tailspin. October 16, 2025, the KBW Regional Banking Index posted its worst performance relative to the S&P 500 since March 2023, when Silicon Valley Bank failed. Fortunately, the remainder of Q3 earnings season went off

largely without a hitch. No new cockroaches scurried out from beneath the refrigerator, and the prices of bank stocks stabilized.

Does that mean all is well? Perhaps. Dimon has a reputation for making conservative assumptions about the economy – a desirable trait for the person leading the largest bank in the US. And by some measures, consumer balance sheets have strengthened in recent months. In the latest Household Debt and Credit report from the New York Federal Reserve, delinquency rates for the most sensitive lending products, credit cards and auto loans, stabilized in Q2, as did mortgage and HELOC delinquencies. Only delinquencies for student loans, a category distorted by the pandemic-era payment pause, saw a material deterioration in the most recent quarter.

At the same time, we can’t pretend Dimon’s warning doesn’t come at a precarious moment. The US economy faces growing pressures from a softening labor market, persistent inflation, and uncertainty caused by tariff policy.

Stay tuned.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Bureau of Economic Analysis: https://www.bea.gov/data/gdp/gross-domestic-product

Bureau of Labor Statistics: https://www.bls.gov/

US Census Bureau: https://www.census.gov/retail/sales.html

Federal Reserve: https://www.federalreserve.gov/

New York Federal Reserve: https://www.newyorkfed.org/microeconomics/hhdc

Market performance data sourced from Bloomberg Finance L.P. and Optuma